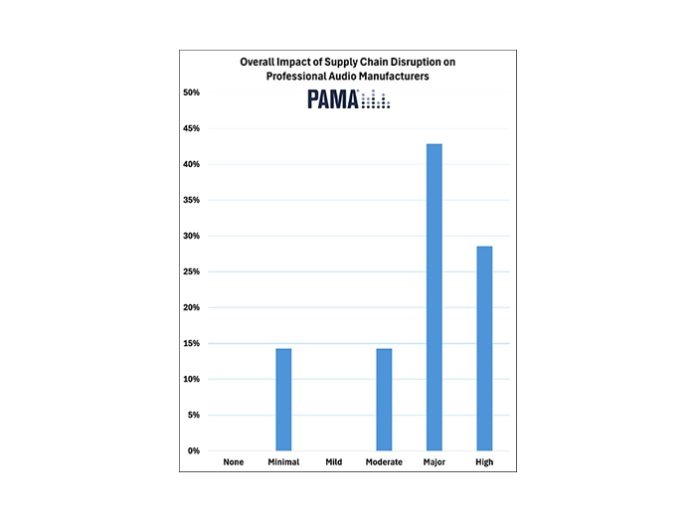

Approximately 86% of professional audio manufacturers responding to a recent survey reported that their companies were moderately to majorly affected by pandemic-born supply chain disruptions and the simultaneous interruptions in semiconductor fabrication.

The survey, conducted by the Professional Audio Manufacturers Alliance (PAMA) of its member companies, whose product lines span the gamut of audio specialties, revisited the topic of pandemic-era supply chain issues seeking an overview of lessons learned, practices adapted and whether concerns were lingering. None of the respondent companies said they were unaffected by the supply chain crisis, though 14% said they were barely affected.

Supply chain issues and the shortfall in semiconductor availability had major or high impact on how 72% of the manufacturers source materials and components, with another 14% citing moderate effects. “We committed substantial resources to increase our inventory,” shared Chris Regan, Chief Innovation Officer and co-founder of RF Venue (and Chair of PAMA’s Board of Directors). “Luckily, we did not experience the long-term stockouts that affected other manufacturers. We relentlessly marketed the fact that we had product in stock and gained a lot of new business as a result when competitors could not ship their product.”

“The pro audio industry took a backseat to the automotive industry with regards to prioritisation of IC supply,” said David Fuller, QSC VP, Engineering & Product Management – Pro Audio.

James Lamb, President, CEO and co-founder of Point Source Audio, says the mic maker “front-loaded key raw materials early on.”

Along with “spot buys” of parts, Dane Roth, Global Corporate Communications Senior Director for Shure, said “re-engineering products” with parts and components that promised future availability came into play. Sennheiser’s executive vice president United States, Greg Beebe, echoed that Sennheiser also implemented “strategic purchasing and redesign.”

QSC’s Fuller too cited “product redesigns” as a means of adjusting to component scarcity. On average, respondents said that the way their company designs and develops products was only mildly affected by the supply chain disruptions, though the responses varied widely, with 57% saying there was little effect and 43% citing a moderate to high degree of impact.

57% of the survey respondents concluded that the supply chain disruptions minimally affected or had no effect on their product shipping and distribution methodologies, while 43% again said those methodologies were majorly or highly affected. Remaining post-crisis concerns relate to shipping times and rates for some respondents, whether by ocean, air or land. “QSC’s Fuller specifically noted shipping time concerns in the Red Sea and Panama Canal.”

Conversely, RF Venue “are not experiencing any unordinary supply chain issues,” said Regan, which he credits to RF Venue having its manufacturing “largely in-house.”

Point Source’s Lamb is also among those who report that the pandemic-era issues are not lingering though he shares that Point Source is “constantly checking for issues with raw materials.”

Beebe reports that Sennheiser remains vigilant over maintaining inventory. “Fulfilling a large backorder has provided the market with sizeable stock of Shure product, which means lowered demand for some products at this point. Those [distribution and dealer] customers may be overstocking for themselves to avoid another shortage situation in the future,” Roth said.

“Because of the supply chain disruptions in the market, we proactively made the move to design, build and test our products in the USA,” Regan concluded. “It may not be an approach that works for all products, and in certain cases it is more expensive, but when you factor in the amount of cash that needs to be tied up for large overseas suppliers and add in the freight costs and time delay for delivery, being in control of production in-house becomes a very attractive option. I see other manufacturers doing the same and have a sense that there is a large ‘onshoring’ effort going on in the US across many industries.”

This survey was PAMA’s third investigating supply chain issues since 2021. “The pandemic is largely behind us and the lessons learned are now entrenched in our industry’s practices,” said Regan. “Supply chain issues and the potential effects of new factors on the international professional audio marketplace, including proposed tariff changes on imports and exports, are hot topics that PAMA will continue to monitor and report on into 2025.”